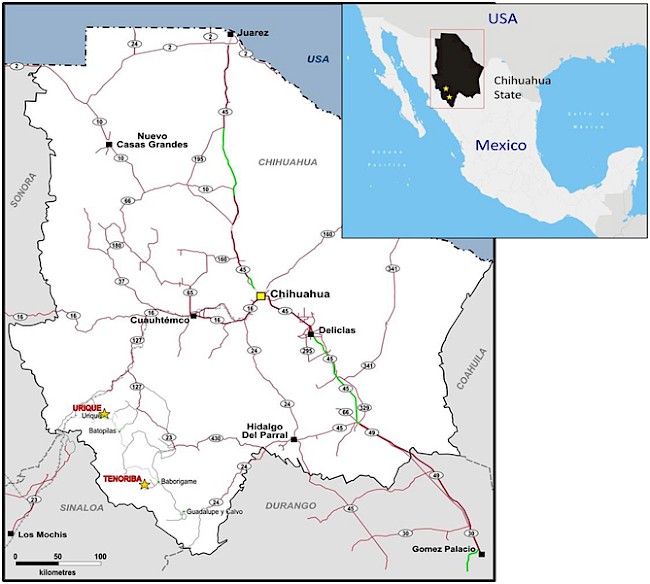

Toronto, Canada (July 3, 2012) - Mammoth Resources Corp. (TSX-V: MTH) is pleased to announce that it has signed a definitive agreement to option the Tenoriba gold and silver project located in southwestern Chihuahua State, Mexico (refer to Figure 1. Location Map - Tenoriba Property, Chihuahua State, Mexico), (the "Agreement"). Tenoriba is comprised of three concessions, Mapy 1, Mapy 2 and Fernanda, covering a land package of approximately 8,100 hectares located approximately 100 kilometres south-southwest of Mammoth's Urique Project. Previous exploration activity on the property, including 2,566 metres of drilling, has yielded potentially attractive gold values (see below). An estimated $2.0 million was spent on the property during 2007-2008.

The terms of the Agreement permit Mammoth to acquire 100 percent of the Tenoriba property by issuing a total of 950,000 Mammoth shares and making total cash payments of $160,000 to the vendors over the four year option period and spending US$1,000,000 in exploration expenditures on or before June 30, 2016. In addition, the Company has recently paid US$40,000 in property back-taxes owing to the Mexican government. The Agreement also allows for a 2 percent Net Smelter Return royalty payable to the vendors upon commercial production. The royalty can be purchased by Mammoth at any time within a three year period from commencement of commercial production for US$1,500,000.

Mammoth President and CEO Thomas Atkins commented on this Agreement, stating: "This option agreement illustrates how the combination of knowledgeable people on the ground, good relationships and available capital can come together to advance a great opportunity. Our objectives are to see money spent in the ground to ensure the development of the property with both Mammoth shareholders and the vendor realizing value from their respective holdings in Mammoth shares. We look forward to reporting on progress from our initial program to consolidate all historical data and to map and sample the entire property area. Our work program, scheduled to begin within days, should extend towards the end of the year and should be easily funded from the company's available cash."

Mammoth Vice President Exploration, Richard Simpson added: "We're very excited to be able to begin field work that will enable us to advance our interpretation of the geology of the property and, as a top priority, to better understand the source and extent of the 45 grams per tonne gold intersection in drill hole TDH-07. Evidence of gold mineralization, the type of rock in which this mineralization is hosted and the grades and widths intersected in this hole and others in the area are extremely encouraging. With this option Mammoth inherits an estimated two million dollars worth of recent exploration data, including all drill core and exploration infrastructure such as drill roads and a camp facility."

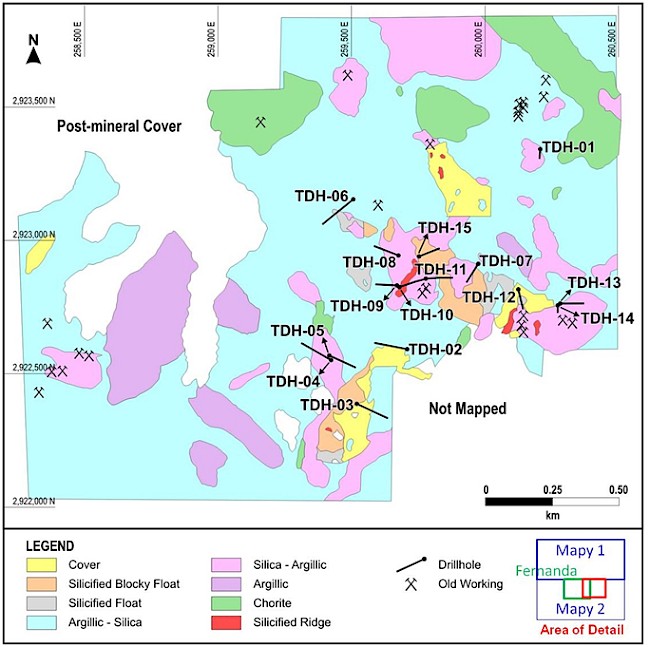

Previous exploration, including an initial 15 diamond drill holes totaling 2,566.0 metres (all of the core from this drilling is available at the on-site exploration camp) and 2,586 geochemical soil and rock chip samples, was completed in 2007-2008 by Masuparia Gold Corporation (the previous optioning party). Diamond drill locations are illustrated in Figure 2 - Drill Hole Location Map, Masuparia Gold Diamond Drilling (2009), Tenoriba Property. Some of the most attractive intersections from this 2008 drill program included:

| Drill Hole Number |

From | To | Interval Length | Gold (Fire Assay) |

|---|---|---|---|---|

| (metres) | (metres) | (metres) | (gpt) | |

| TDH-01 | 3.50 | 14.70 | 11.20 | 0.54 |

| TDH-07 | 35.00 | 51.00 | 16.00 | 0.49 |

| 61.00 | 64.70 | 3.70 | 5.33 | |

| (including) | 62.80 | 64.70 | 1.90 | 45.90 |

| 120.50 | 132.00 | 11.50 | 2.26 | |

| (including) | 129.50 | 132.00 | 2.50 | 9.21 |

| TDH-11 | 27.30 | 67.00 | 39.70 | 0.48 |

| 40.80 | 49.00 | 8.20 | 1.45 | |

| 110.00 | 144.40 | 34.40 | 1.03 | |

| (including) | 116.80 | 124.20 | 7.40 | 2.82 |

| (including) | 135.00 | 144.40 | 9.40 | 1.37 |

| TDH-12 | 21.00 | 46.60 | 25.60 | 0.56 |

| TDH-14 | 50.00 | 62.00 | 12.00 | 0.64 |

Results were contained in a press release by the previous optionor; Masuparia Gold Corporation on June 30, 2008 (refer to Sedar, Masuparia Gold Corporation) and were approved by Masuparia's QP and met industry QC standards. High grade assays (anything above 10.0 grams per tonne) were cut to 10.0 grams per tonne when incorporated in any composite assay intervals

Transaction Details:

Mammoth will pay to the vendors of the Mapy 1and Mapy 2 concessions, comprising a total of 7,600 hectares of the Tenoriba property, payments in cash and Mammoth shares, as follows:

| Date | Shares | Cash (US$) |

|---|---|---|

| 30/12/2013 | 75,000 | --- |

| 30/06/2014 | 75,000 | --- |

| 30/12/2014 | 75,000 | $12,500 |

| 30/06/2015 | 75,000 | $12,500 |

| 30/12/2015 | 87,500 | $18,750 |

| 30/06/2016 | 87,500 | $18,750 |

| TOTAL | 475,000 | $62,500 |

In respect of the option of the Fernanda concession, comprising a total of 500 hectares centered within the two adjoining Mapy concessions, Mammoth will pay to the vendor payments in cash and Mammoth shares, as follows:

| Date | Shares | Cash (US$) |

|---|---|---|

| 30/12/2012 | 50,000 | $5,000 |

| 30/06/2013 | 50,000 | $5,000 |

| 30/12/2013 | 50,000 | $12,500 |

| 30/06/2014 | 50,000 | $12,500 |

| 30/12/2014 | 50,000 | $12,500 |

| 30/06/2015 | 50,000 | $12,500 |

| 30/12/2015 | 62,500 | $18,750 |

| 30/06/2016 | 62,500 | $18,750 |

| TOTAL | 425,000 | $97,500 |

In addition, Mammoth will incur on or before June 30, 2016 a total of US$1,000,000 in exploration expenditures across both the Mapy and/or Fernanda concessions with the timing and distribution of such expenditures at the sole discretion of Mammoth.

Upon exercising the Mapy options Mammoth will grant a 2 percent Net Smelter Return royalty to the vendors of the minerals exploited from the Mapy concessions and a similar 2 percent Net Smelter Return royalty to the vendor of the minerals exploited from the Fernanda concession. Mammoth's Mexican subsidiary shall have the exclusive right of repurchase of each of these royalties for a period of 3 years from the date of commercial production at a cost of US$750,000 each.

About Mammoth Resources:

Mammoth Resources (TZX-V: MTH) is a mineral exploration company focused on acquiring and defining precious metal resources in Mexico and other attractive mining friendly jurisdictions in the Americas. The Company has an option to acquire 100% of the Urique Property and the Tenoriba Property located in the Sierra Madre Precious Metal Belt in southwestern Chihuahua State, Mexico and continues to seek other option agreements on other properties it deems to host above average potential for economic concentrations of precious metals mineralization.

Qualified Person / Quality Controls:

Richard Simpson, P.Geo.,Vice-President Exploration for Mammoth Resources Corp. is Mammoth's Qualified Person, according to National Instrument 43-101, for the Tenoriba property and is responsible for any technical data mentioned in this news release.

Mr. Simpson sampled 4 intervals from available core from the Masuparia 2009 diamond drill program and collected 16 rock chip samples from various outcrops previously sampled on the property. Samples were prepared and analyzed by ALS CHEMEX in their facilities in Mexico and Canada, respectively. Samples generally consisted of 1-3 kg of material. Gold analyses were performed by 30 gram fire assay with an AA finish. Silver, copper, lead and zinc were analyzed as part of a multi-element ICP package using an aqua regia digestion. In the opinion of Mr. Simpson, the samples he took and analyzed compared favourably with historic results for these samples achieved by Masuparia.

To find out more about Mammoth Resources and to sign up to receive future press releases, please visit the company's website at www.mammothresources.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information: This news release may contain or refer to forward-looking information. All information other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements; examples include the listing of its shares on a stock exchange and establishing mineral resources. These forward-looking statements are subject to a variety of risks and uncertainties beyond the Company's ability to control or predict that may cause actual events or results to differ materially from those discussed in such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, undue reliance should not be placed on these forward-looking statements due to the inherent uncertainty therein.

For further information please contact:

Thomas Atkins

President & CEO

tom@mammothresources.ca

Figure 1. Location Map - Tenoriba Property, Chihuahua State, Mexico

Figure 2 - Drill Hole Location Map, Masuparia Gold Diamond Drilling (2009), Tenoriba Property